Schedule K-1 2024 – Inheriting property or other assets typically involves filing the appropriate tax forms with the IRS. Schedule K-1 (Form 1041) is used to report a beneficiary’s share of an estate or trust . Partnerships have general partners and limited partners. Both types of partners report losses on Schedule K-1. Limited partners are not financially responsible for losses in the company .

Schedule K-1 2024

Source : schedule-k-1.pdffiller.comSchedule K 1 Forms Available in March Western Midstream

Source : www.westernmidstream.comIRS Schedule K 1 (1065 form) | pdfFiller

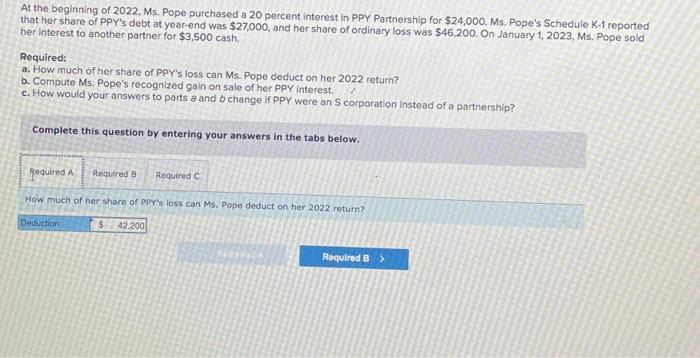

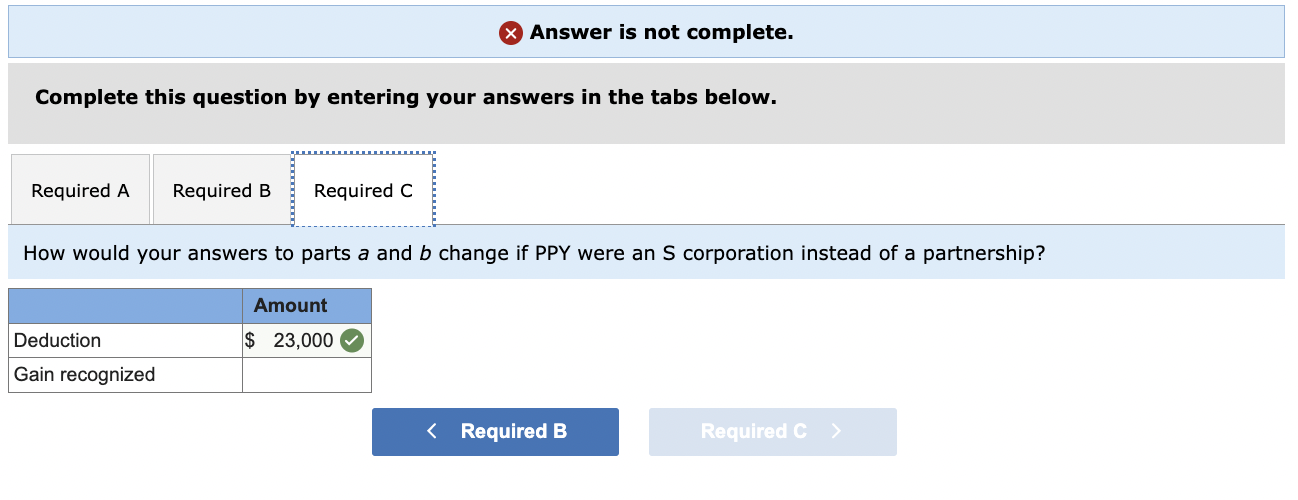

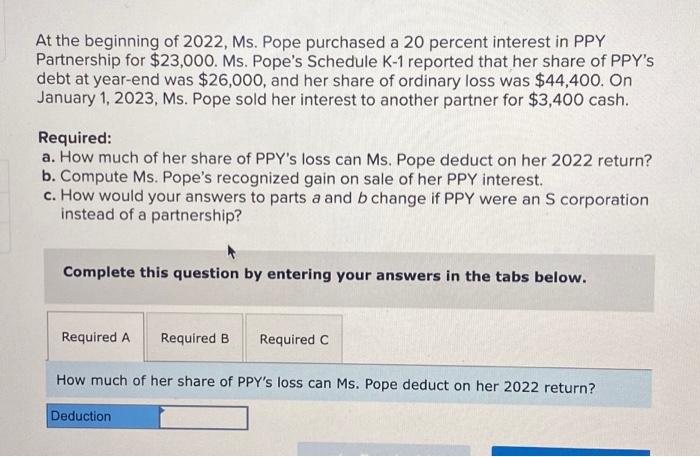

Source : www.pdffiller.comSolved At the beginning of 2022 , Ms. Pope purchased a 20 | Chegg.com

Source : www.chegg.com2023 Form IRS 1041 Schedule K 1 Fill Online, Printable, Fillable

Source : 1041-k-1.pdffiller.comSolved At the beginning of 2022, Ms. Pope purchased a 20 | Chegg.com

Source : www.chegg.comNuStar Energy L.P.’s Update on Availability of 2023 Schedule K 1

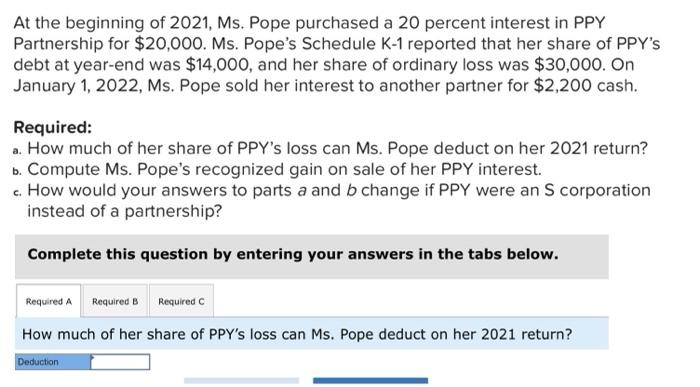

Source : finance.yahoo.comSolved At the beginning of 2021, Ms. Pope purchased a 20 | Chegg.com

Source : www.chegg.comYouth Basketball 2024 Schedules The YMCA of Vincennes

Source : vincennesymca.orgSolved At the beginning of 2022 , Ms. Pope purchased a 20 | Chegg.com

Source : www.chegg.comSchedule K-1 2024 2023 Form IRS 1065 Schedule K 1 Fill Online, Printable, Fillable : NuStar Energy L.P. (NYSE: NS) today provided an update on the expected availability of the Partnership’s 2023 tax packages, which include the Schedule K-1 for common units. . Schedule K-1 (Form 1065) If you receive income from a partnership, the IRS will send you schedule K-1 every tax year. You do not return this form to the IRS. Instead, you use schedule K-1 as a .

]]>